In the U.S. and around the world, e-commerce continues expanding its influence. According to the National Retail Federation, online and other non-store sales grew more than 10% compared to this time last year.1Meldner, Richard. U.S. November Retail Sales are Up with eCommerce Leading the Way. eSellerCafe. December 18, 2017. That strong growth helps explain why more brick-and-mortar retailers want to get in on the e-commerce action.

Recent global headlines have focused on the retail rumble between Walmart and Amazon in their common quest to get ‘phygital’ by selling through both physical stores and online service. While both companies seek omnichannel excellence, they are approaching this goal from opposite ends of the retail spectrum.

In Part 1, we looked at how Amazon’s approach to phygital retail includes expanding its brick-and-mortar presence. Now let’s look at how brick-and-mortar retailers, including Walmart, are investing more in online service.

E-commerce is a retail essential

While more than 90% of retail still takes place in stores, e-commerce continues to grow in strategic importance.2U.S. Census Bureau. U.S. Department of Commerce. November 17, 2017. That’s because today’s tech-savvy, “always on” consumers now expect omnichannel service from retail companies. As experts at Vend state, “Omnichannel is now the standard. Retailers who continue to invest in their omnichannel strategies will succeed.”3Retail Trends and Predictions 2017: 12 forecasts for the retail industry in 2017. Vend. December 2016.

Walmart’s e-commerce expansion

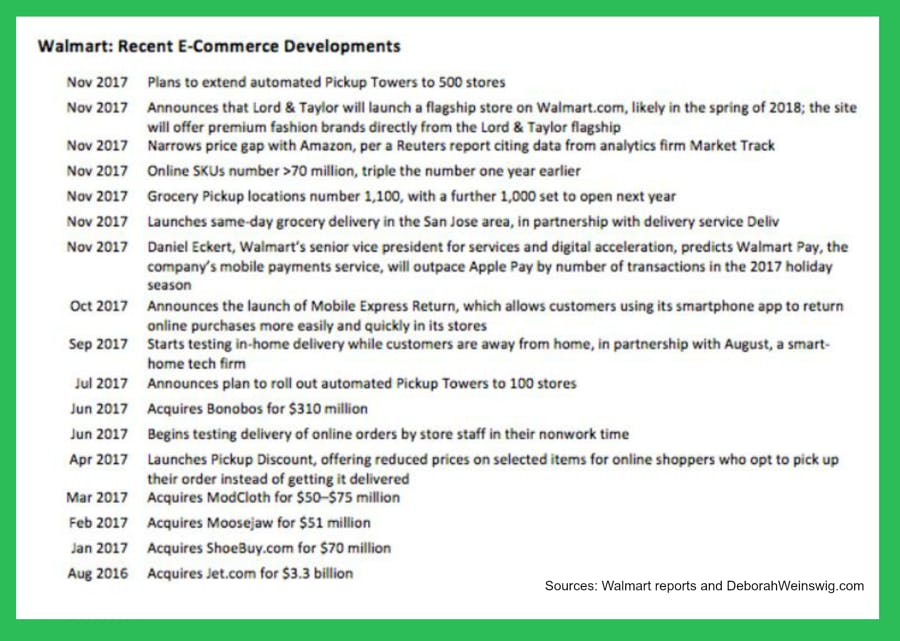

To strengthen its competitive position, Walmart went on a lavish e-commerce shopping spree this year, as summarized in the timeline above.4Weinswig, Deborah. Channel Swaps: Walmart Online vs. Amazon Offline. Deborahweinswig.com. December 1, 2017. The retail giant acquired online grocery and apparel brands Jet.com (in 2016), ShoeBuy, Moosejaw, ModCloth, and Bonobos. Walmart also acquired New York-based, same-day delivery service Parcel, and partnered with Uber, Lyft, and Deliv delivery services last year.

For more robust e-commerce offerings, Walmart tripled its online product assortment and dramatically increased its grocery pickup locations. To encourage shoppers to buy online and pick up in store (BOPIS), Walmart rewarded consumers with discounts, as in-store pickup saves the retailer shipping and handling costs. Physical stores also make online shopping easier with a customer-centric buy online, return in store (BORIS) policy.

In addition, Walmart invested in in-store pickup towers, which prompted Business Insider reporters to marvel, “we were shocked by how easy and quick it was to use… we were in and out of the store in under a minute.”5Peterson, Hayley. Walmart is unleashing a key weapon against Amazon in 500 stores. Business Insider

Retail leaders embrace digital service

Just last week, Target agreed to buy grocery-delivery startup Shipt to compete directly with Amazon and Walmart by accelerating same-day shipping.6Boyle, Matthew. Target to Buy Shipt for $550 Million in Challenge to Amazon. Bloomberg. December 13, 2017. While e-commerce reduces Target’s need for physical stores and overhead, it also increases the retailer’s logistics costs, including fast home delivery.

In the beauty segment, cosmetics giant Sephora’s in-store experience reflects online and offline convergence. A digital Beauty Board allows shoppers to browse user-generated content and find products featured in in-store photos.7Sephora’s Digital Makeover. Technology and Operations Management, Harvard Business School. November 18, 2017. Shoppers can even personalize those images to show products most likely to flatter their own skin tone.

Even suppliers see the value of online service. To engage shoppers at the individual level, more consumer packaged goods (CPG) suppliers are offering direct-to-consumer service, including Campbells, Hershey, and Kellogg.8Weinswig, Deborah. What’s Around The Corner In 2018? A Preview Of Next Year’s Retail And Consumer Trends. Forbes. December 8, 2017.9Ciolli, Joe. The retail apocalypse is causing one company to rethink its entire strategy. Business Insider. July 27, 2017.10Skrovan, Sandy. Kellogg focuses on e-commerce growth. Food Dive. September 11, 2017. Direct service allows CPG suppliers to build deeper relationships with shoppers. They can also use their digital presence to gather consumer data insights, which they can then apply to make their marketing more relevant and effective.

Why e-commerce is a retail priority

To understand why more brick-and-mortar stores are strengthening their e-commerce offerings, here are some potential factors behind their rationale:

- Companies must be where consumers are: For sales growth, retailers are allocating resources to e-commerce to reach people who prefer online to the in-store experience. Retailers’ use of digital also includes popular social media platforms, like Instagram, Pinterest, Facebook, and Snapchat. To engage consumers and sell goods, retailers give social media users behind-the-scenes glimpses of their operations to build brand awareness and loyal followings.11Retail Trends and Predictions 2017: 12 forecasts for the retail industry in 2017. Vend. December 2016.

- Offer omnichannel options: Expanding their service choices, including BOPIS and BORIS, leverages retailers’ abundance of brick-and-mortar stores to support online shopping pickups and returns.

- Consumers crave convenience: Consumers reward companies that save them time, including offering home delivery and hassle-free shopping with no lineups.

- E-grocery is poised to explode: Online grocery shopping is growing as nearly 8% of U.S. consumers shopped for groceries online in the past 30 days, up from less than 6% two years ago, and it’s driven by millennials and Gen X shoppers.12Skrovan, Sandy. Food for thought: 7 trends set to define grocery retail in 2017. RetailDive. January 5, 2017.

When implementing a phygital strategy, retail companies may wish to consider the 12 suggestions in Engage Shoppers With Omnichannel Personalization.

To stay relevant, modern, and customer-centric, more brick-and-mortar retailers – and even suppliers – are increasing their investments in digital engagement, including e-commerce and social media. Balance is important between online and offline service because, despite e-commerce growth, experts expect 70% of retail sales will still occur in stores in 2020.13Pappas, Christopher. Experiential Retailing Is Transforming the Use of CRE. Commercial Property Executive. July 13, 2017. To succeed in retail, companies need to consider a phygital strategy and timeline that reflect the needs of their company and their consumers.